Top 15 Bike Insurance Companies in India

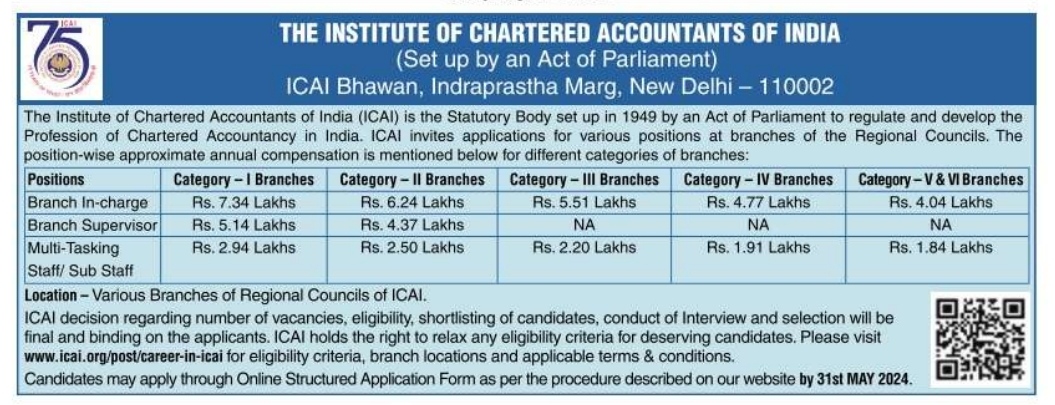

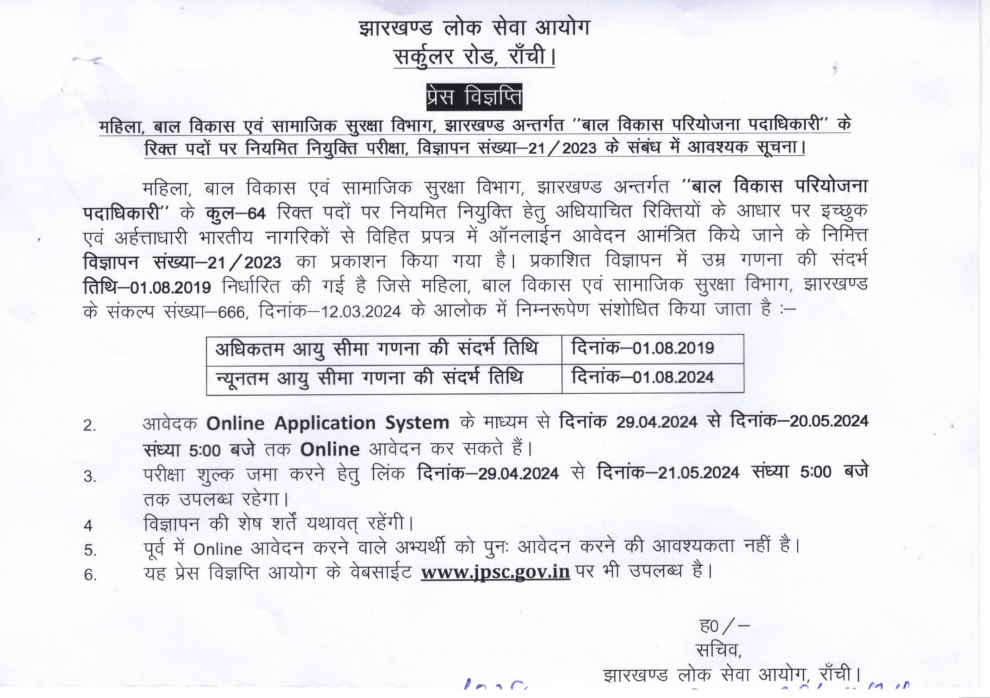

The table below offers info associated to the perfect bike insurance firms in India, together with their network/cashless garages and Declare Settlement Ratio (CSR):

Top 15 Bike Insurance Companies in India

| Two-Wheeler Insurance Company | Cashless Garages | Claim Settlement Ratio |

| Bajaj Allianz Insurance General Insurance Co. Ltd. | 4500+ | 96.5% |

| Cholamandalam MS General Insurance Co. Ltd. | 6912+ | 98.0% |

| Future Generali India Insurance Co. Ltd. | 3500+ | 87.4% |

| GO DIGIT General Insurance Ltd. | 1400+ | 97.0% |

| HDFC ERGO General Insurance Co. Ltd. | 2000+ | 100.0% |

| IFFCO Tokio General Insurance Co. Ltd. | 4300 | 95.8% |

| Kotak Mahindra Insurance Co. Ltd. | 3000+ | 98.0% |

| Liberty General Insurance Ltd. | 4300+ | 98.0%% |

| National Insurance General Insurance Co. Ltd. | 900+ | 93.0%% |

| The New India Assurance Co. Ltd. | 1173+ | 91.0% |

| The Oriental Insurance Co. Ltd. | 3100+ | 94.0% |

| Reliance General Insurance Co. Ltd. | 8700+ | 98.6% |

| SBI General Insurance Co. Ltd. | 16000+ | 94.0% |

| Shriram General Insurance Co. Ltd. | 2000+ | 98.0% |

| TATA AIG General Insurance Ltd. | 7500+ | 98.0%’ |

| United India Insurance Co. Ltd. | 500+ | 95.0% |

| Universal Sompo Insurance Co. Ltd. | 3500+ | 90.0% |

| ZUNO (Edelweiss) General Insurance Co. Ltd. | 1500+ | 89.0% |

How Do You Select the Most Appropriate Bike Insurance Company in India?

Below is a list of pointers that you should take into account whereas shopping for a two-wheeler insurance policy:

1. Network of Cashless Garage

Each bike insurance firm has a tie-up with a few of the two-wheeler workshops or garages. These garages are often known as community garages or community workshops of insurance firms. At these garages, you may avail the ability of cashless claims. Subsequently, when choosing a ‘two wheeler insurance coverage, you must also verify its checklist of community garages. The one which covers many garages, some in your close by premises, must be thought of.

Top 15 Bike Insurance Companies in India

2. Claim Settlement Ratio

CSR or Claim Settlement Ratio refers back to the share of the claims {that a} bike insurance firm settles out of the particular variety of claims acquired in a single monetary yr. The upper the CSR, the higher the corporate’s well being. Subsequently, you should choose a two-wheeler insurance firm with a great declare settlement ratio.

3. Availability of Add-ons

The add-on covers are the extra covers you should buy with complete bike insurance and standalone injury insurance coverage to increase the fundamental protection by paying some further premium. Nevertheless, this further premium may be very nominal. Subsequently, earlier than choosing a motorcycle insurance firm, you should additionally verify whether or not it affords add-on covers that you could be want.

Top 15 Bike Insurance Companies in India

4. 24*7 Customer Assistance

One other important issue to think about earlier than selecting a two-wheeler insurance policy is the corporate’s buyer care service. The standard and availability of customer care companies must be checked earlier than finalizing a two-wheeler insurance coverage firm. You have to choose a company that gives 24*7 customer care service and provides you well timed help for resolving your queries and issues related to an insurance policy.

As we take care of our different assets, we must also care for our most treasured possessions, i.e., bikes, by getting a suitable two-wheeler insurance policy. With the assistance of this text, you can make the suitable choice to pick out the suitable bike insurance plan in your bike.

“Top 15 Bike Insurance Companies in India”

Read more news : Click Here